Our scalable solutions simplify the process of creating and operating individual savings and investments plans (Robo Advisor), employee savings schemes, and portfolio tracking and management. Enjoy new, effortless and automated solutions configured to the specific needs of your organisation.

Learn more about our cutting edge fintech solutions for both corporate and enterprise clients and group savings scheme to increase productivity and employee retention.

This is a goal-based savings and investments Robo Advisor for wealth management and retail customers.

An all-inclusive solution for tracking, aggregating, and reporting on all investments in one place.

Provides modern, user-friendly interfaces that serve all key participants in financial planning.

Saving solutions are not just for employees, we have a retail offering too!

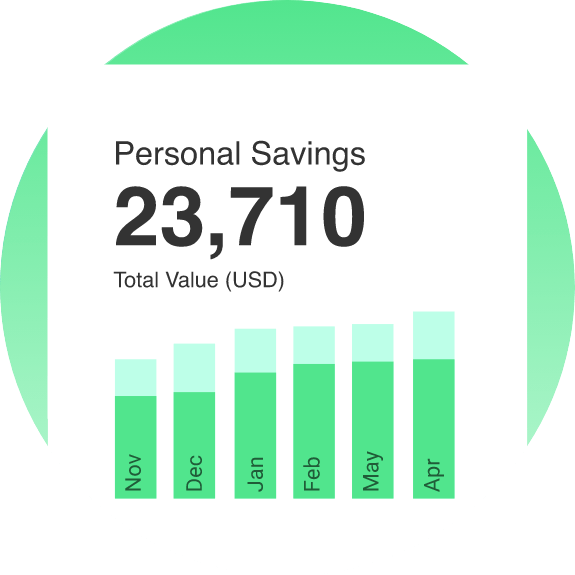

Personal savings are fundamental to wealth building and financial security. Your customers need a safe and easy way to make their savings grow and our ISP plan offers just that wrapped in a neat little bow.

You can now offer these ISPs to retail customers with our state-of-the-art goal-based savings and investment. Customers can calculate how much to save for goals such as kids education, dream house or a retirement income. Customers can track their progress and performance of their investments in real time with this user-friendly platform.

Complete your ESP setup in a matter of minutes with our smart savings solution and easy to use platform.

Workplace saving plans are typically either funded by employees, the company, or both. Each contribution setup can be uniquely created to your needs whether from one multiple sources.

Our highly configurable system allows for any number of rules and benefits to be included in the Employee Savings Plans in the shape of “Membership levels”. Employers can reward their executive and key employees with more control, better options and fewer vesting rules, or create a standard set of rules and options for all employees using this feature.

Vesting rules are an optional element that regulate employees’ access to the company’s contributions. These rules can be utilised in your configuration to ensure that contributions are earned over time.

PortfolioManager allows users to create and manage multiple investment portfolios within one account. The solution supports a diverse range of investments, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other listed and non-listed assets.

Users can add trades or import data from other trading platforms, making it possible to bring and consolidate all investments in one place. Easily upload investment data from numerous brokers and platforms, thus saving time and eliminating manual entry errors.

Generates various performance reports over different periods and calculates both time-weighted and dollar-weighted returns, allowing users to evaluate their investment performance in different perspectives. It provides real-time updates on asset pricing, enabling users to readily monitor their portfolio’s movements. Users can also track dividends and view detailed information on dividend payments, yields, and historical distributions.

PortfolioManager provides a dashboard of key metrics of portfolio performance and management, helping investors track their investments efficiently and meaningfully. Moreover, it provides benchmarking tools that empower users to compare their portfolios performance against relevant indices of their choice.

Our insurance-linked solutions provide modern, user-friendly interfaces that serve all key participants in financial planning, including policyholders, intermediaries and insurers.

We help insurance companies enhance their product digital experience, investment choice for life policies and optimize operations with our integrated offerings.

Utilise our proprietary calculators to identify risks and plan for your future employee liabilities.

Employers can take initiative and prepare for their employees’ ESBs by investing in high-yield options. Because of this product, they can sit back and watch their investments safely grow.

Our smart technology tracks investment performance and progress, while feeding customers with all the information daily from a convenient and user friendly dashboard.

18th floor Nordic Tower,

Building 79, Road 2802,

Block 429, Seef Business Area,

Kingdom of Bahrain.

© Copyright MenaMoney 2024 All Rights Reserved.